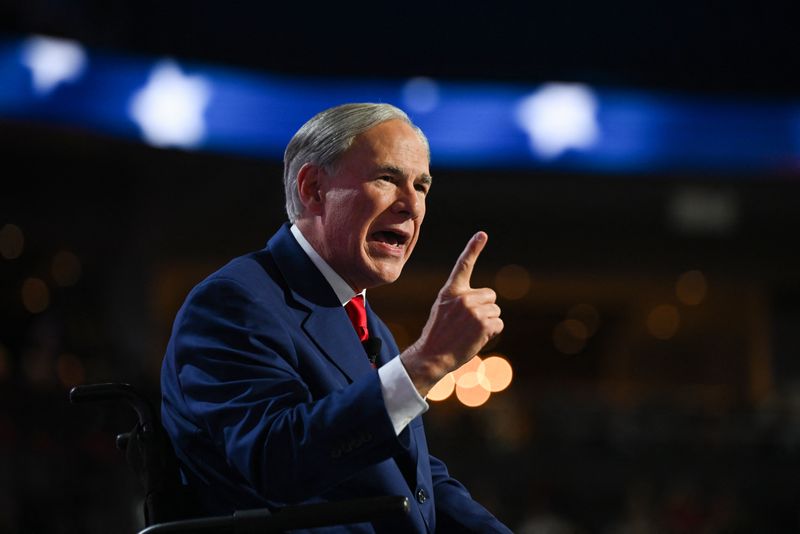

In a letter to state agencies dated Nov. 21 and posted to his website, Republican Greg Abbott said “belligerent actions” of China’s ruling Communist Party had increased risks to Texas’ investments in China, and told investors to get out.

“I direct Texas investing entities that you are prohibited from making any new investments of state funds in China. To the extent you have any current investments in China, you are required to divest at the first available opportunity,” he said.

Texas has been taking an increasingly activist stance in its agencies’ investments, having previously restricted public pension funds from doing business with Wall Street firms that have embraced environmental, social and governance principles.

Its state agencies include the Teacher Retirement System of Texas, which had $210.5 billion under management at the end of August, according to its annual report.

The TRS has roughly $1.4 billion exposure to Chinese yuan and Hong Kong dollar assets, and listed Tencent Holdings (OTC:TCEHY) as its 10th largest position, worth about $385 million at current prices.

Abbott’s letter said he had told the University of Texas/Texas A&M Investment Management Company (UTIMCO), which manages nearly $80 billion, to divest from China earlier this year.

Neither Texas Teachers nor UTIMCO responded immediately to a request for comment outside business hours.

Markets in China fell sharply on Friday, with the Shanghai Composite down 3%. Tencent shares were about 2% lower in afternoon trade in Hong Kong, in line with the broader market.

Dealers said trade had been light in Hong Kong and sentiment already weak as Chinese authorities have disappointed expectations for economic stimulus, but that the news had added to the downbeat mood.

“Even though we all know that there will be more and more policies against China from the U.S…. whenever there’s any news like this, it will hit the sentiment here,” said Steven Leung, executive director at brokerage UOB Kay Hian in Hong Kong.

To read the full article, Click Here