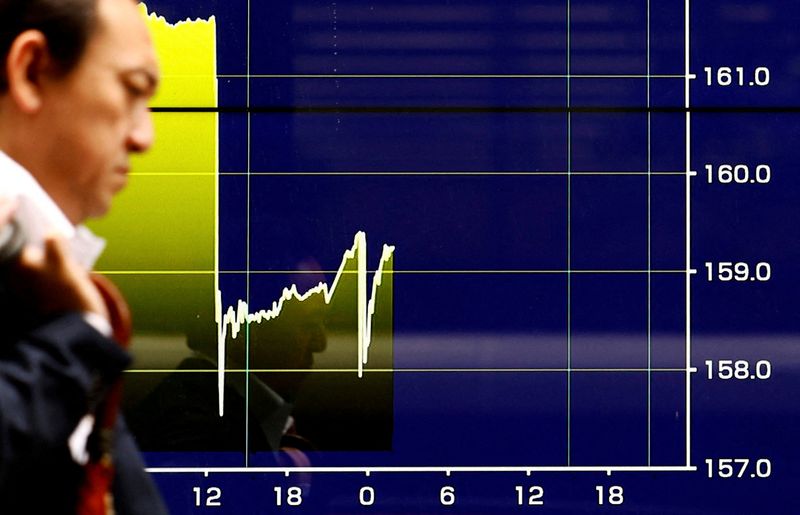

HONG KONG (Reuters) – Global hedge funds made a massive retreat from their bearish bets on the Japanese yen during the currency’s strong rise against the U.S. dollar over the last two weeks, a UBS note to clients seen by Reuters on Tuesday said.

Hedge funds covered nearly all the short yen positions built up over the last year, as the yen rallied by roughly 5% against the U.S. dollar since July 10, UBS said in a note on Monday, citing its internal forex flow data without disclosing the numbers.

A nearly $40 billion suspected intervention by Japanese authorities has driven the yen to roughly 153 per dollar from around 162 per dollar in mid-July.

“I think the Bank of Japan’s goal is to convince investors not to bet against them and to push the market to deleverage the carry trade,” Zhiwei Zhang, president at hedge fund Pinpoint Asset Management, said.

The reversal in the yen’s trend also disrupted popular carry trades whereby an investor borrows in a currency with low interest rates and invests in a higher-yielding currency.

The yen was the most popular funding currency as Japan has the lowest interest rate among the G10 currencies. Analysts said investors must seek alternatives now the yen has become too volatile.

Japan’s central bank started a two-day policy meeting that will conclude on Wednesday. Market traders have shown caution this week as they await upcoming interest rate decisions and details of its plan to gradually retreat from its huge purchases of government bonds.

Not everyone is convinced by the BOJ’s intervention, however, and views on the yen’s future direction are growing divergent.

In contrast to the hedge funds’ pull-back, the real money community, or traditional long-only asset managers, used “the recent yen rally as an opportunity to keep selling the currency,” UBS said in the same note.

To read the full article, Click Here