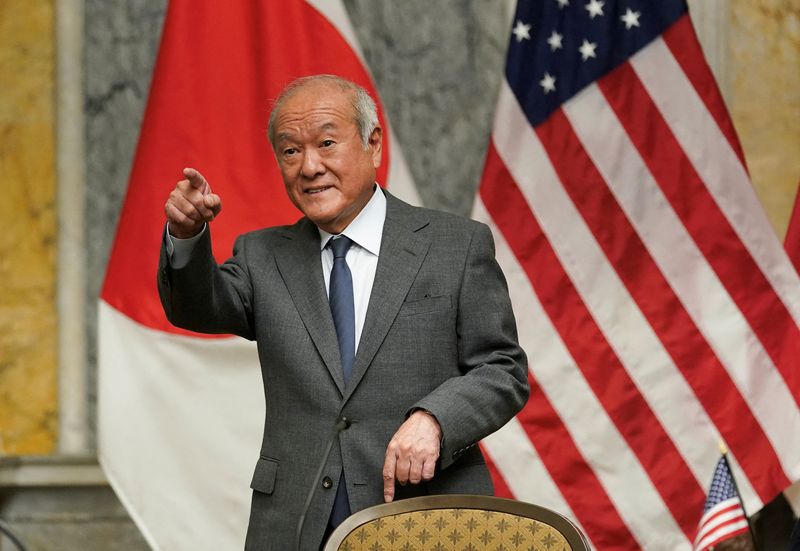

“Foreign exchange intervention should be done with its necessity and effectiveness taken into account,” Suzuki said, speaking in a regular post-cabinet meeting news conference.

While intervention could be used to contain excessive moves in the currency market, such action “should be conducted in a restrained manner,” Suzuki said.

Data from the finance ministry on Friday showed that Japan’s foreign reserves fell to $1.23 trillion at the end of May, down $47.4 billion from a month earlier, largely due to a drop in foreign securities holdings.

Japanese authorities wouldn’t reveal the make-up of the country’s foreign reserves, but most of the foreign securities holdings are believed to be in U.S. Treasuries.

“It is almost certain that Japan sold part of its U.S. Treasury holdings to finance dollar-selling, yen-buying intervention,” Ueno Tsuyoshi, senior economist at NLI Research Institute, said.

Data from the Ministry of Finance showed last week that authorities spent 9.79 trillion yen ($62.85 billion) intervening in the market to support the yen, widely believed to have occurred in late April and at the start of May.

($1 = 155.7800 yen)

To read the full article, Click Here