Bitcoin falling back to $25,000 would mark its “last big dip” before the next BTC price bull run, says Cane Island’s Timothy Peterson.

Markets News

Bitcoin (BTC) can easily end up below $25,000 next month, says one longtime market observer.

In a new BTC price outlook, Timothy Peterson, founder and investment manager at Cane Island Alternative Advisors, put the odds of a dip to local lows at 50/50.

BTC price may see “last big dip” in September

While Bitcoin bulls continue their breakout attempts above $30,000, various popular traders and analysts have their sights on lower levels.

Peterson, well known for his technical insights, now believes that the typical August and September performance may yield a return to the $25,000 mark.

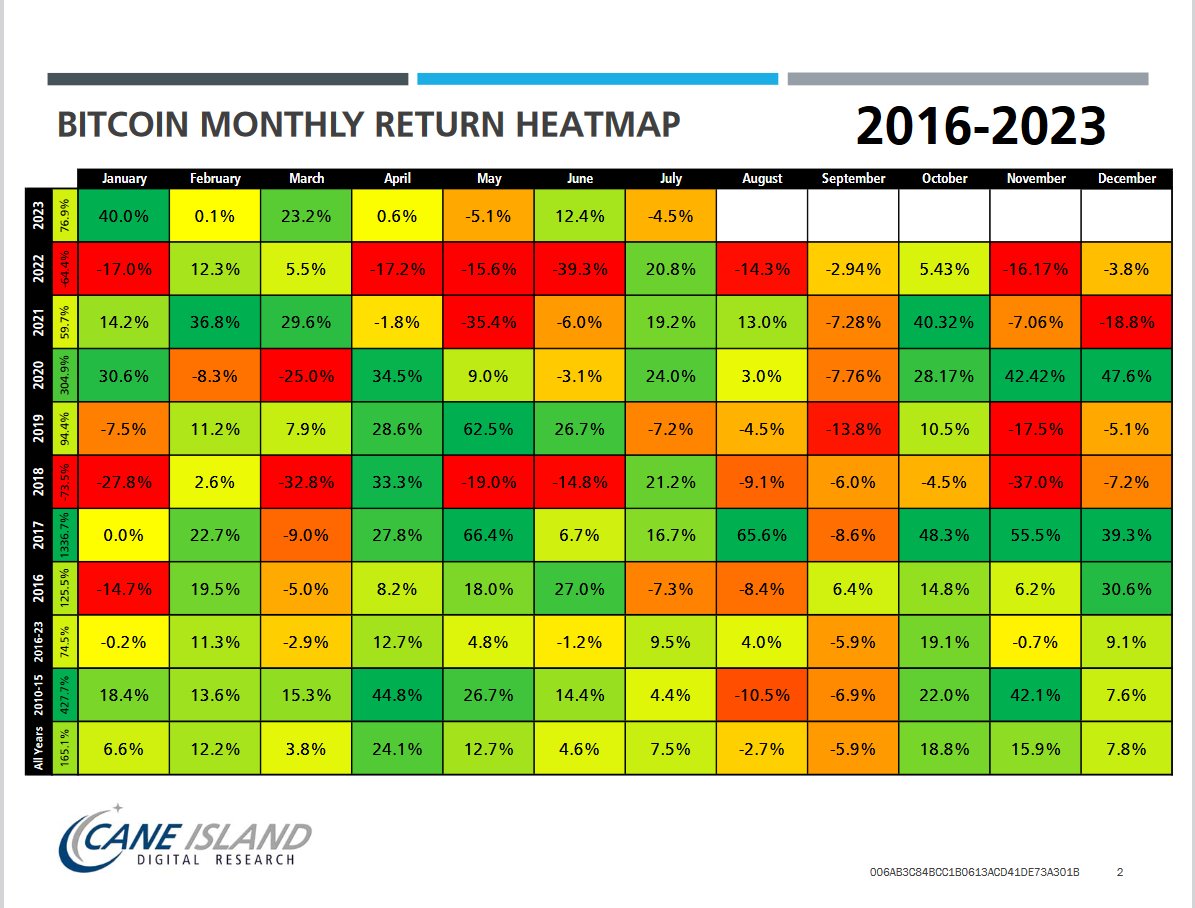

Uploading a chart of monthly performance statistics for BTC/USD to X (formerly known as Twitter), he concluded that a “last big dip” may hit before September is over. Put another way, BTC price downside over the next six weeks or so could top 15%.

“There is a 50% chance that bitcoin will drop below $25,000 before the end of September,” accompanying commentary stated.

“This would be the last big dip before the next big bull run cycle commences.”

As Cointelegraph reported, September is traditionally a “bad” month for Bitcoin bulls. Since 2017, BTC price action has finished the month lower than its starting price every year.

August, meanwhile, is a mixed bag, offering either modest gains or modest losses, with 2017 as a notable exception.

Bitcoin Lowest Price Forward says $100,000 by mid-2026

Continuing, Peterson doubled down on Bitcoin’s bullish outlook.

Related: Bitcoin price can go ‘full bull’ next month if 200-week trendline stays

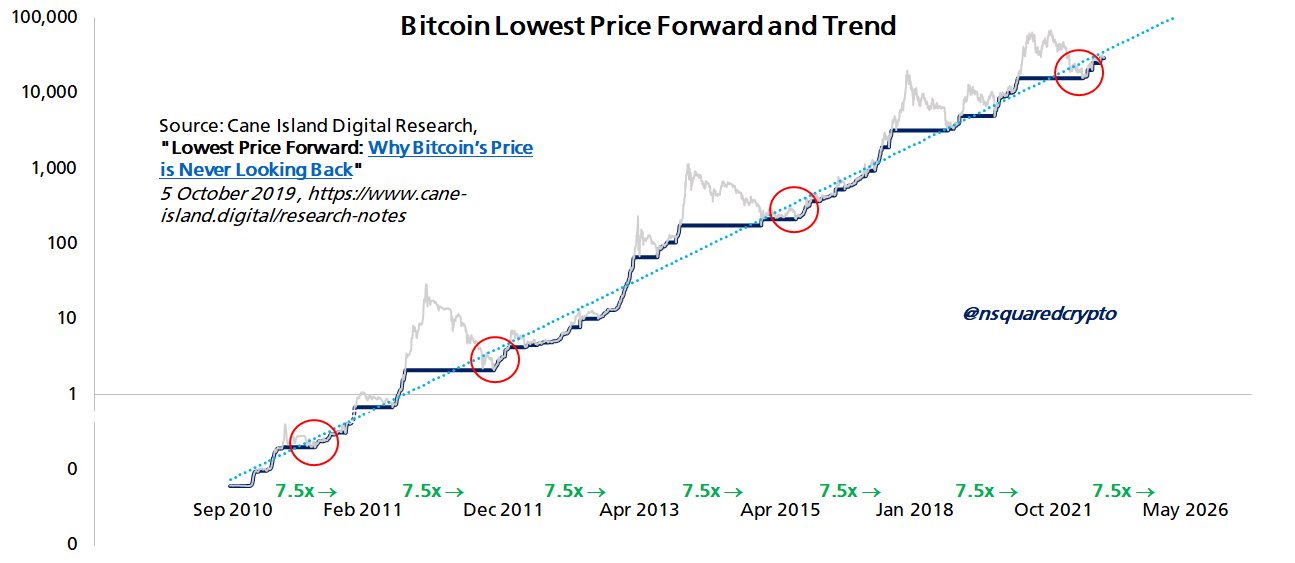

In addition to predicting a final significant retracement before the bull run, recent analysis gave a deadline of less than 1,000 days — less than three years — for BTC/USD to hit a giant $100,000.

This came courtesy of the “Lowest Price Forward” metric, which delivers price prognoses for specific dates in the future.

Formerly known as a calculator of Bitcoin’s “never look back price,” Its claim to fame lies in correctly predicting Bitcoin’s last ever visit to $10,000 in September 2020.

“If you dismissed Bitcoin’s ‘Lowest Price Forward’ trend because of the dip in 2022, remember that Bitcoin’s price normally dips below the trend after a bear market,” a confident Peterson wrote in an X post on Aug. 8.

“Bear markets are for waiting, not doubting. Bitcoin is less than 1000 days away from $100K.”

Magazine: Deposit risk: What do crypto exchanges really do with your money?

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.