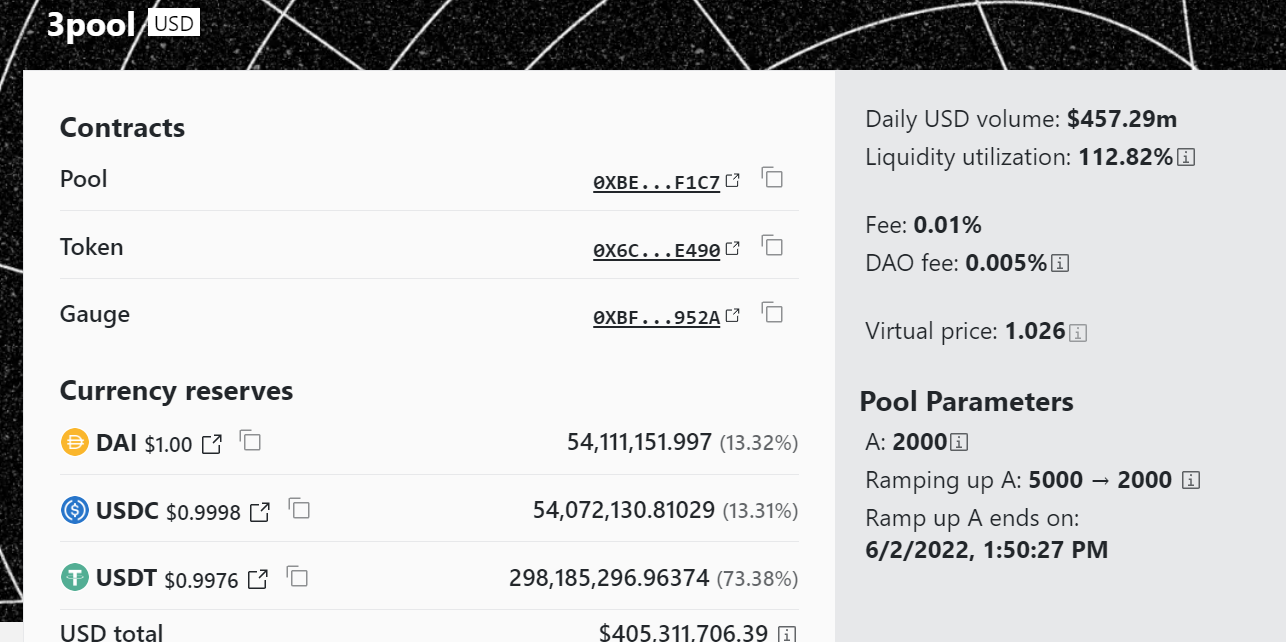

The stablecoin pool ideally has a weightage of 33.3% of each USDT, USDC and DAI, however, on June 15, the USDT weightage rose above 70% in the pool.

News

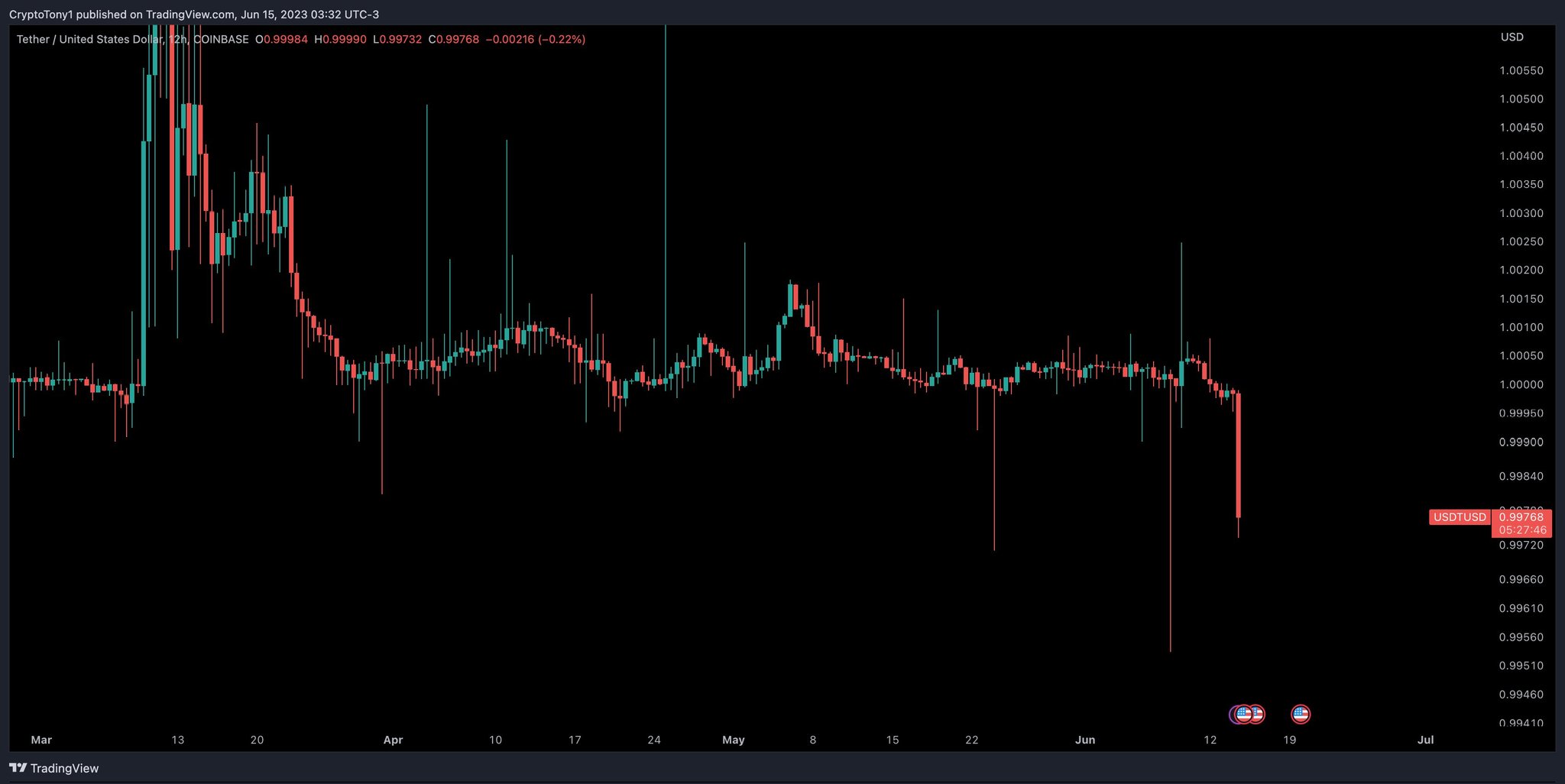

Tether-issued USDT (USDT) stablecoin slightly deviated from its dollar peg value on June 15 due to an imbalance in the Curve 3pool. The price of USDT fell by 0.3% to around 0.997 as the USDT weightage in the curve 3pool increased to over 70% from the ideal 33.1%.

Curve’s 3pool is a stablecoin pool for decentralized finance that holds a massive amount of liquidity of the three top stablecoins in DeFi- USDT, USDC and DAI. A significant rise in a particular stablecoin weightage in the curve pool indicates a heavy selling of that stablecoin.

With USDT weightage at around 73.8%, it means traders are increasingly selling their USDT for DAI or USDC. USDT concentration in Curve 3pool exceeded over 50% last in November 2022 at the time of FTX collapse.

The main cause of the imbalance was attributed to a whale address called CZSamSun that borrowed 31.5 million USDT and swapped it for Circle issued USD Coin (USDC) leding to slight deviation in USDT’s dollar-peg value. With the help of 17,000 ETH and 14,000 stETH as collateral and then converted the borrowed sum into USDC using 1inch.

The borrower then made deposits to V2 and V3 totaling $10 million and $21 million, respectively. Following that, the borrower took out a USDT loan of 12 million from V3 and deposited it into V2.

Approximately 20 minutes after czsamsun.eth borrowed USDT, another address (0xd2…0701) mortgaged 52,200 stETH through Aave V2 and borrowed 50 million USDC. Using the USDC>USDT de-peg, with a few million USDC,

The slight deviation for USDT price helped the USDC/USDT trading pair on Binance to rise to a new yerly high of $1.0034. USDT accounted for 73.79% of Curve 3pool, DAI accounted for 13.05%, and USDC accounted for 13.16%.

Related: SEC, CPI and a ‘strong rebound’ — 5 things to know in Bitcoin this week

Tether’s chief technical officer Paolo Ardoino took to Twitter to assure the crypto community that the de-peg scare is nothing to worry about and they are ready to redeem any amount. Later Ardoino also shared a “FUD meme” as well addressing the market rumours around Tether depeg.

— Paolo Ardoino (@paoloardoino) June 15, 2023

The latest stablecoin de-peg scare comes within months of the USDC depeg that ran havoc on many investors’ portfolios. The USDC depegged below $0.9 in March earlier this year as Circle confirmed they had over $3 billion stuck with Silicon Valley Bank. Although Circle managed to gather enough capital to repeg USDC value to the dollar within two days, the panic set in by the de-pegging led to many traders exiting USDC at a loss.

Magazine: Bitcoin is on a collision course with ‘Net Zero’ promises